– What, Who, Why, When, and How Much?

Summing Up Roth Conversions

Converting a traditional IRA to a Roth IRA means transferring securities from the traditional IRA to the Roth, paying ordinary income tax on the value of the securities transferred, and resulting in a tax-free pot of money that will grow completely tax-free, even into future generations. There is no income limit to convert, conversions can be partial or complete, and the deposits into the Roth must be in the account for five years for the earnings to be tax-free. Roth conversions cannot count for Required Minimum Distributions (RMD) which are annual mandated withdrawals, based on life expectancy tables, from traditional IRAs and other retirement accounts that begin at age 72. In other words, the withdrawals used for conversions must be in addition to the RMD.

By having this tax-free pot of money to withdraw from during retirement, you can potentially avoid paying taxes on social security, avoid IRMAA Medicare surcharges, and save many thousands of dollars in future taxes.

You Need More Than a Traditional IRA

A Roth IRA or Roth 401(k) creates a tax-free way to grow money. The deposits into these accounts are after- tax; there is no tax deduction like there is for the traditional IRA and 401(k). Roth IRAs, named after Delaware Senator William Roth, became a savings option in 1998, with Roth 401(k)s following in 2006. Withdrawal requirements are:

- You can withdraw your principal at any time since you’ve paid taxes

- Earnings and growth must be in the account for at least five years to qualify for tax-free

- The account holder must be 59.5 years old to avoid paying a 10% penalty for early withdrawal.

- There are no Required Minimum Withdrawals unless it is an inherited Roth IRA.

Congress enacted Internal Revenue Code Section 401(k) as part of the Revenue Act on November 6th, 1978. As of 2019, around 80 million people held $5.7 trillion in 401(k) assets. United States Department of Labor Private Pension Report p. 2-3. Trillions more have rolled over to IRAs.

Throughout your career, the 401k system works great. Contributions are tax-deductible, companies often match a portion of contributions, investments are chosen from a selection of mutual funds, or you can self-direct a portfolio of individual stocks, bonds, ETFs, and REITS which can grow tax-deferred for decades.

However, like most things in life, there is a downside. With 401(k)s, the downside is the looming future tax bill on all the trillions of dollars in 401(k)s and traditional IRAs. Deferred taxes are an excellent benefit! But being in a lower tax bracket during retirement is a thing of the past when all of your retirement savings are in accounts subject to withdrawals at the ordinary tax rate, especially when the marginal rate during retirement is likely to be higher than during employment.

Careful tax planning is a critical component of retirement planning. One way to mitigate the tax burden in retirement years is to ensure that you have also saved outside your 401k. To minimize taxes during retirement, wealth must be balanced throughout three account types 1)Traditional 401ks, 2) other taxable accounts that offer lower capital gain and dividend tax rates available for withdrawals at any age, and 3) Tax-free vehicles such as Roth IRAs and 401ks. Implementing regular partial Roth IRA conversions will be a valuable tool for many.

1/3

A Roth Conversion Moves Assets Out of Traditional IRA, Pays Taxes, and Deposits the Remainder into a Roth IRA

A Roth conversion is when money and securities are moved from a Traditional IRA account into a Roth account. This a taxable event; you are, in effect paying income tax now to create a tax-free source of funds in the future.

Various Roth conversion types are listed below:

- Money transfers from a traditional IRA into a Roth IRA.

- Rolling over a 401(k) to a Roth IRA.

- Moving money from a standard 401(k) into a Roth 401(k) account.

- A backdoor Roth IRA. Note – “backdoor” refers to the process, not the account. The result is a standard Roth IRA conversion. It is called a backdoor because it involves contributing to a traditional account, then converting that account to a Roth. This works for people whose income is too high to qualify for contributing to a Roth.

A Roth Conversion is not for Everybody, but Many Should Ask the Question.

- Young people who can save considerable amounts and expect their income to climb over the years

- IRA owners who expect to be in the same or higher tax bracket in retirement

- People who have accumulated over $500,000 in an IRA and a 401k

- People who are retired and have over $500,000 in IRAs and 401ks but have not yet started Required Minimum Distributions

- People who will not use all of their IRA and want to help their heirs with tax planning.

Conversions May be Great for Any Age, but Especially at retirement.

If you fall into one of these groups, you owe it to yourself to ask the question.

- If you are a high earner of any age. Remember, though, the current tax savings for contributing to a traditional 401k are meaningful, and the younger you are, the more years of tax deferral you have. Additionally, before I recommend Roth conversions, I encourage clients to save both inside 401ks (or similar accounts like a 403b, 457, etc.) AND outside of retirement accounts by using a simple brokerage account.

- After a certain level of investment has been reached. For example, I typically consider Roth conversions for clients surpassing the $500,000 mark in traditional retirement accounts.

- When retiring from a full-time career.

- When Required Minimum Distributions will begin within a few years.

- ESTATE PLANNING: When you know that your heirs will inherit a significant amount in the form of your traditional IRA. Under the new law, heirs no longer have the ability to amortize their withdrawals over their lifetime. The new rule requires all funds to be withdrawn within ten years. Suppose the retirement account is a traditional IRA,401k,403b,3tc. The withdrawals will be fully taxable to your kids, often during the exact period of their high-earnings career phase.

2/3

Convert an Amount that Lets You Maximize Your Current Tax Bracket.

You’ve determined that you fit into one of the groups that should be asking the question about Roth conversions, now how do you decide how much to convert?

If you are under 65 and active in your career you will be weighing the value of current tax savings for maximum contributions to traditional retirement accounts with the value of lower taxes in the future. As mentioned above, you will have less money to invest in a Roth because you have to pay tax on it.

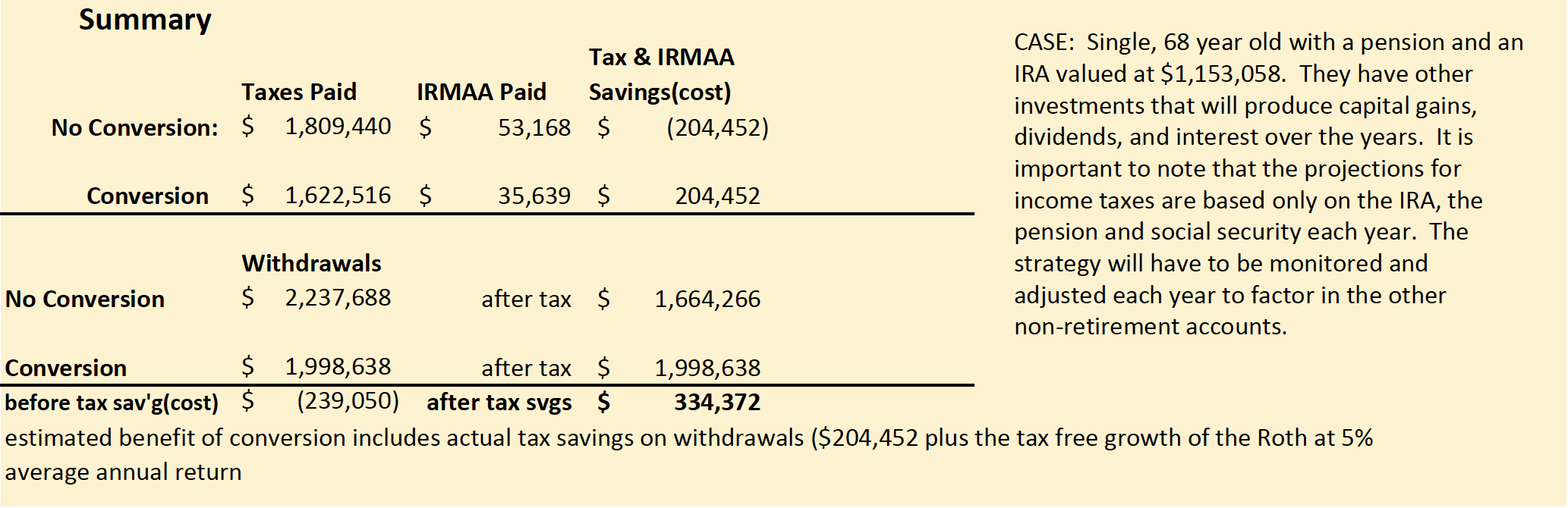

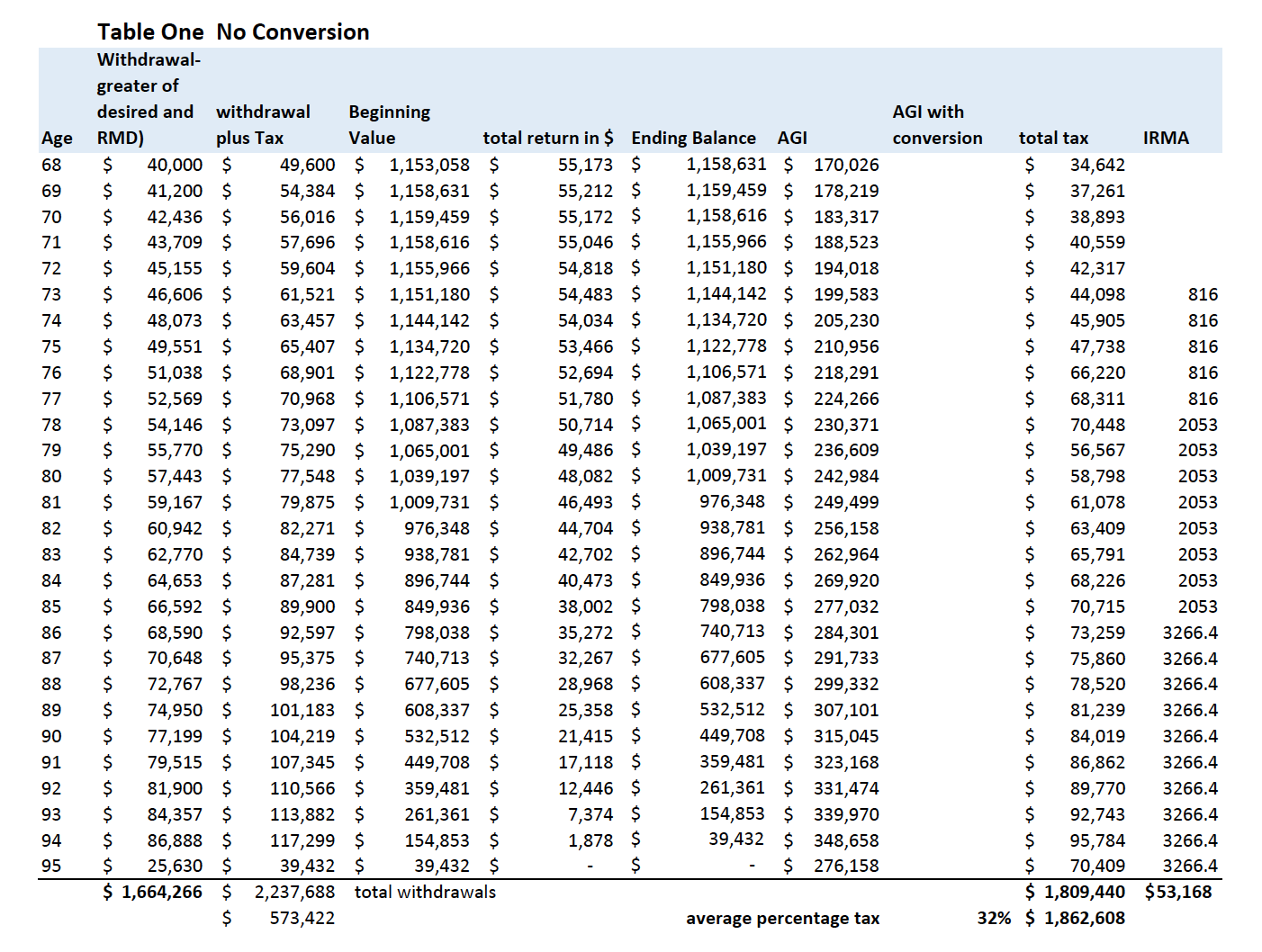

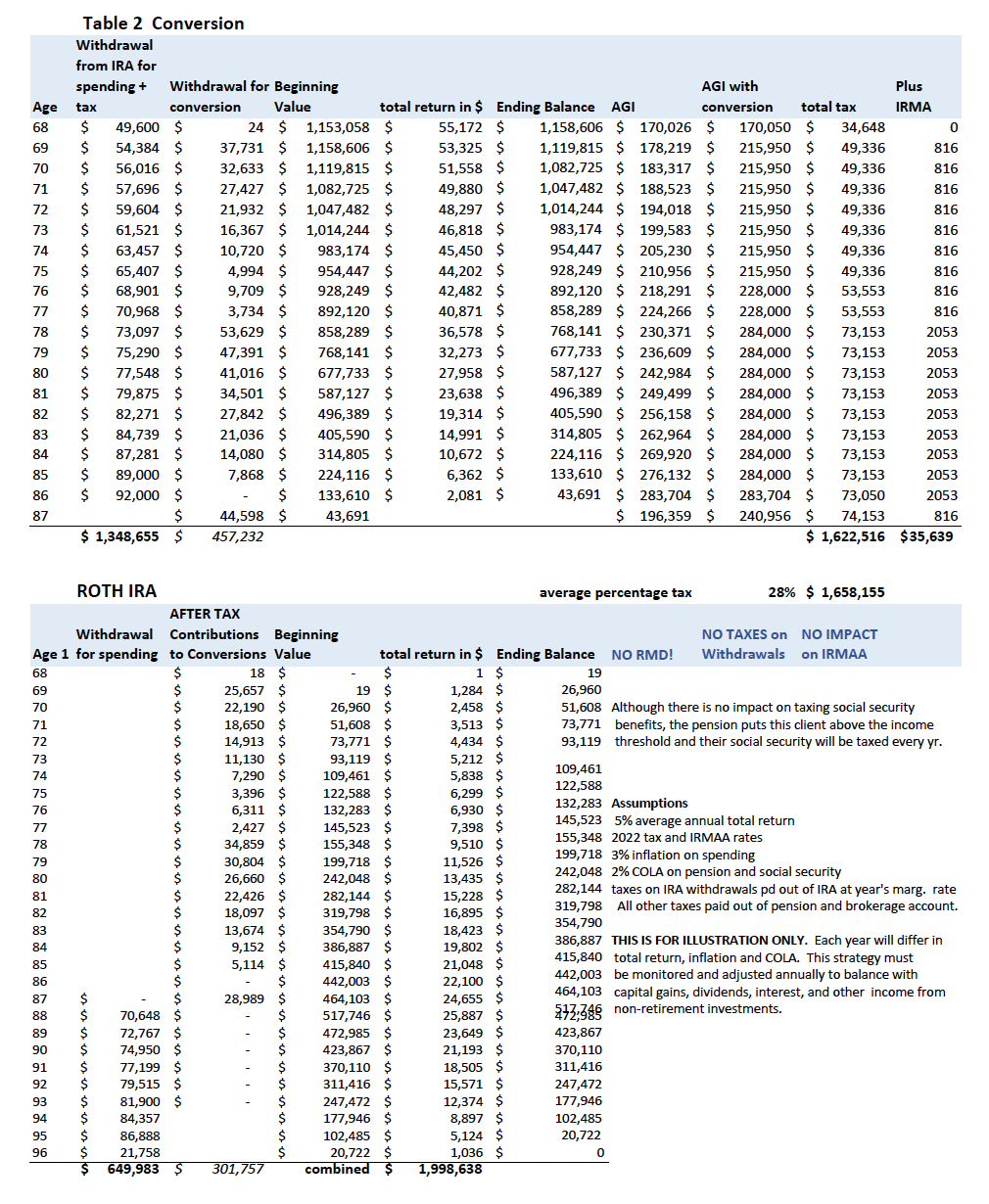

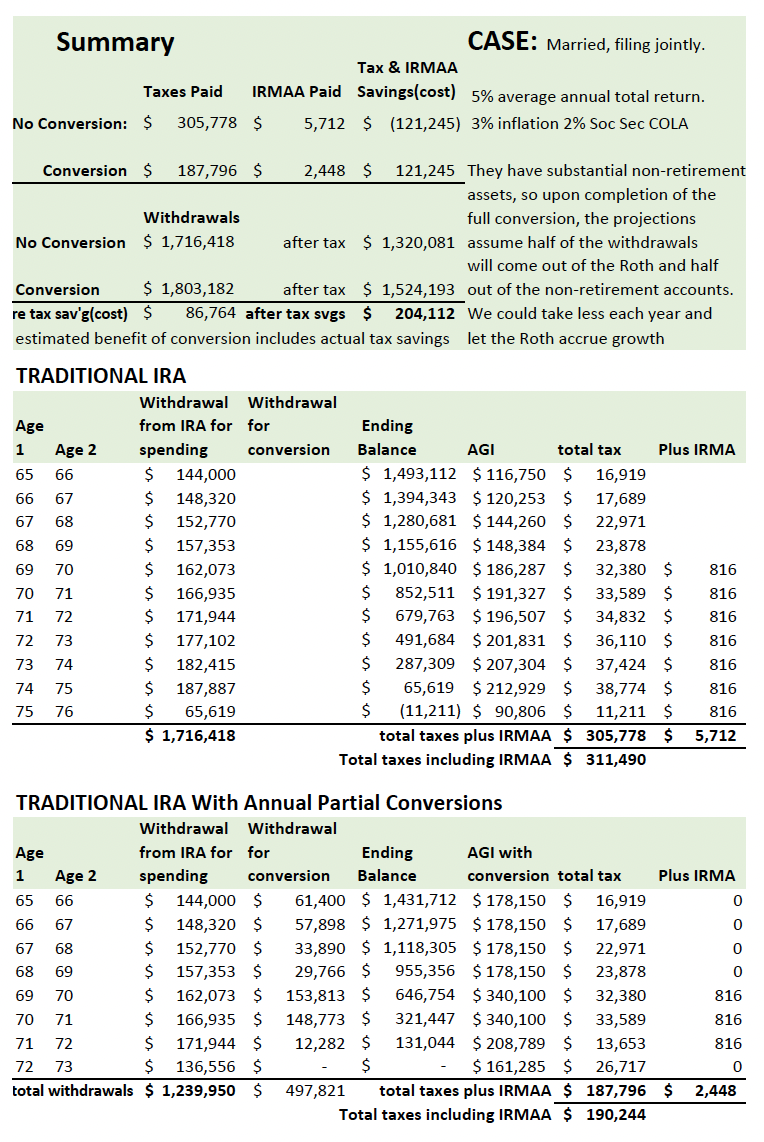

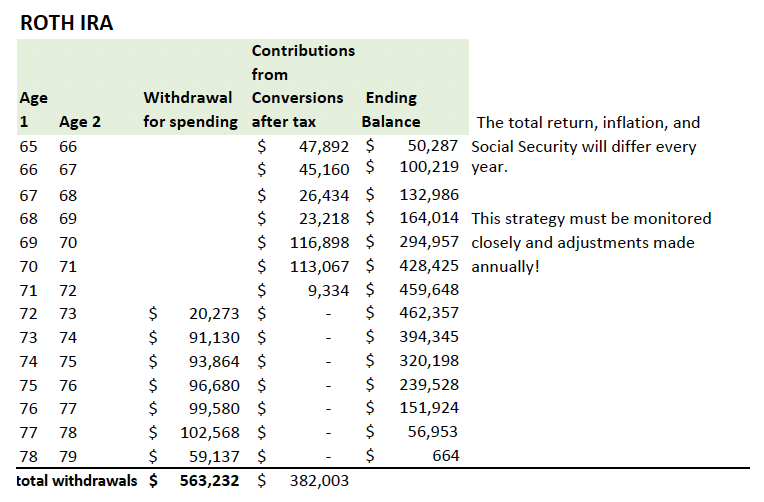

The following tables illustrate a couple of Roth Conversion strategies. Note that both of these examples ignore the fact that the client probably has other investments that may generate capital gains, dividends, and interest. These will need to be evaluated each year and will impact the amount of your best conversion.

Wrapping Up

Ultimately considering a Roth conversion is a complicated matter; seek help from a financial adviser or your CPA before making a final decision. If you are over 65, Roth conversions impact the taxability of Social Security benefits and Medicare premiums. If you are young and a high earner, reducing the number of investible funds by paying the tax on the conversion gives you less to grow. If you defer first and then consider converting, you may find that the ultimate benefit is more significant than rushing to convert because of the ability to reinvest all deferred gains within the traditional retirement accounts. On the other hand, if you are in one of the lower tax brackets, select the Roth option for your 401k and convert the traditional ones.

Timing is essential. Conversions must be done by the end of the year if you want it to count for your tax return.

If you can bear paying taxes now to save significantly more taxes in the future, then give Roth IRA Conversions a serious look. It may benefit you or your heirs greatly.